Challenges of Banks in Climate Alignment of Residential Real Estate.

It was a great pleasure to speak to policymakers during this private finance panel at the Building & Climate Global Forum.

I have brought you a summary of the key points I presented on the challenges of banks in aligning their residential real estate portfolio.

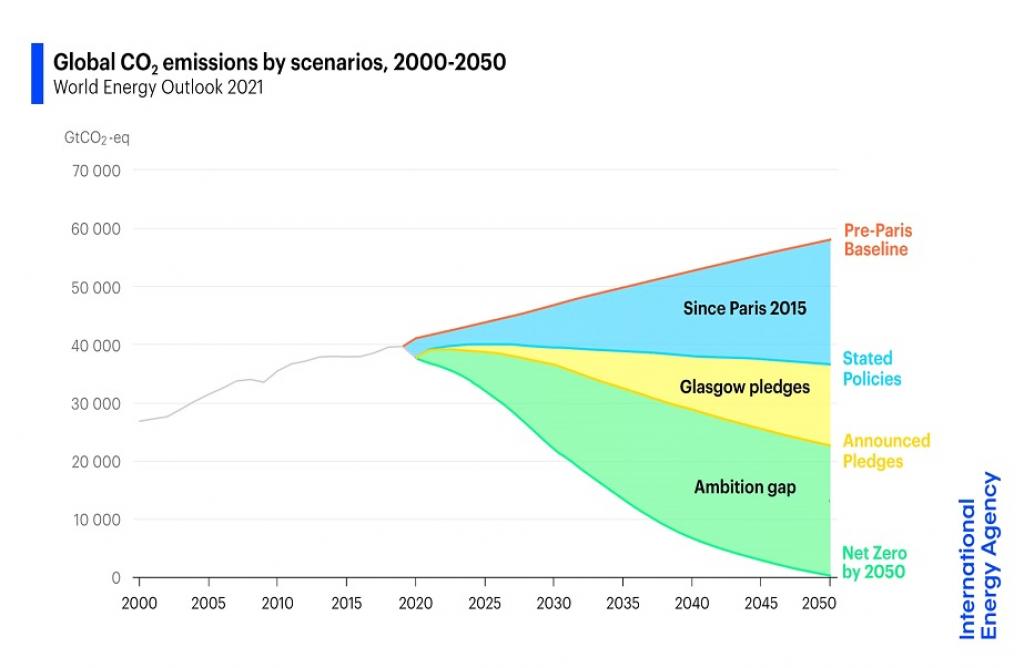

Per the International Energy Agency (IEA) , there is an important ambition gap between the announced pledges (APS) and the net zero scenario (NZE) and to achieve our transition goals, we need to close this gap. This is a big challenge for every sector but even more so for the residential portfolio. That is due to multiple reasons. The stakeholders are homeowners and not corporates. Banks cannot use traditional levers they use to lead the transition of their portfolio.

– A lever used on other sectors is 𝗖𝗹𝗶𝗲𝗻𝘁 𝗘𝗻𝗴𝗮𝗴𝗲𝗺𝗲𝗻𝘁, they require their clients to implement transition plans, reduce their emissions, use sustainable fuels, etc. However, banks can not impose on homeowners to renovate or implement net zero trajectories.

– Another lever banks use is 𝗖𝗹𝗶𝗲𝗻𝘁 𝗦𝗲𝗹𝗲𝗰𝘁𝗶𝘃𝗶𝘁𝘆, they favor clients who have a transition plan or have lower emissions. But in the case of residential, banks are expected to conduct a just transition. Mainly meaning that they need to accompany their clients, no matter their financial power, to finance and renovate their homes. For example, young couples, or students who cannot afford top-tier and environmentally performant buildings. So client selectivity is also not an option.

– 𝗔𝘀𝘀𝗲𝘁 𝗦𝗲𝗹𝗲𝗰𝘁𝗶𝘃𝗶𝘁𝘆 is also a challenge. The role of banks should not be to finance only green assets but to accompany their clients in renovating their assets from brown to green.

– Residential loans have much 𝗹𝗼𝗻𝗴𝗲𝗿 𝗺𝗮𝘁𝘂𝗿𝗶𝘁𝘆 𝗱𝗮𝘁𝗲𝘀 compared to other sectors, in France 25 years. That means to respect their intermediary targets (2030 for example) banks have to focus on improving their stock rather than originating new green buildings, and that is not possible if the clients are not willing to renovate.

– Residential clients have no 𝗿𝗲𝗽𝗼𝗿𝘁𝗶𝗻𝗴 𝗼𝗯𝗹𝗶𝗴𝗮𝘁𝗶𝗼𝗻𝘀 like corporates do, therefore acquiring robust data to assess the performance of banks’ portfolios needs the support of policymakers.

To accelerate the transition of this sector, renovation will be the main lever and it should made accessible to homeowners. Many incentives exist today but they are underused for multiple reasons. The amount of CAPEX expected from homeowners remains high and the return on investment is very long and most of the time longer than the lifetime of the installation itself. Not to mention the operational expenditures that arrive before the return on investment. The incentives need to be further marketed, simplified, and their access criteria softened to allow more people to access these incentives.